As companies face the uncertainties of economic shifts, it’s extra vital than ever to build a monetary plan that could resist a recession. Crafting a recession-proof monetary approach requires careful making plans, smart budgeting, and being proactive in approximately ability-demanding situations. Whether you run a small commercial enterprise or manage a startup, developing a resilient monetary approach is fundamental to not most effective surviving but thriving at some point of hard instances. Below are vital steps to constructing an economic plan that works, irrespective of the economic climate.

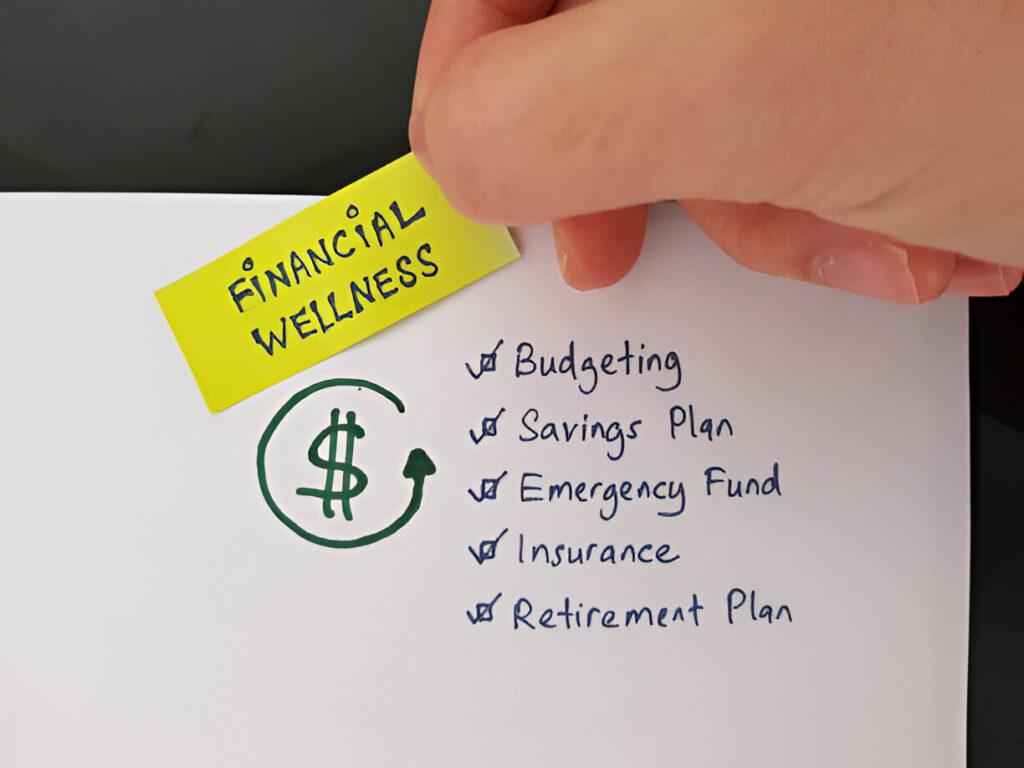

Understanding the Importance of Financial Resilience

When the financial system takes a downturn, it exposes the weaknesses of many companies which might be unprepared. Financial resilience allows your commercial enterprise to climate the typhoon and bounce back more potent. It method has an approach in the area to preserve stability even if revenues dip or prices upward thrust. By having a financial plan that accounts for both growth and downturns, you may make decisions optimistically, understanding you’ve organized for the worst-case scenarios.

Financial forecasting is on the coronary heart of building resilience. Understanding how fluctuations in cash flow, demand, and operational costs can have an effect on your enterprise will provide you with the foresight to alter early and decrease ability damage. With the right financial plan, you could stay centered on lengthy-time-period dreams, even when going through brief setbacks.

Setting Clear Financial Goals for Tough Times

Setting clear, doable monetary desires at some stage in unsure times is vital. Recession-evidence-making plans call for greater than only a vague choice to live afloat; it involves developing precise quick-term and lengthy-term objectives that you could degree and track. During a recession, companies frequently need to shift their cognizance from growth to survival and cash flow control.

Start with the aid of assessing your core economic priorities

Paying off debt, retaining liquidity, or making sure your body of workers is paid at some point of lean months. Once these necessities are covered, you could start considering lengthy-term investments, along with new product lines or expanding your client base. The greater absolutely defined your desires are, the simpler it will likely be to steer your commercial enterprise in the right path, irrespective of outside demanding situations.

Creating a Flexible Budget That Adapts to Change

Flexibility is one of the maximum critical developments of a recession-evidence economic plan. A rigid price range can leave your enterprise susceptible whilst sudden charges get up or profits fluctuate. Instead, focus on constructing a price range this is adaptable to change.

The first step in developing a bendy price range is identifying non-crucial costs that may be reduce while vital. This consists of reviewing ordinary subscriptions, advertising campaigns, or discretionary spending that received’t straight away impact your center operations. By keeping fees under control, you may keep an economic balance at some point of lean times. Furthermore, make it a habit to review your budget regularly, adjusting for shifts in profits or new priorities.

Additionally, don’t forget the use of virtual tools or software to music your budget. These tools can give you real-time insights into your monetary scenario, assisting you make knowledgeable selections quickly. Adopting modern economic control practices will assist ensure that your business stays bendy, efficient, and geared up to evolve at a second’s word.

Building an Emergency Fund for Your Business

Just like individuals, groups want an emergency fund to cushion the blow of surprising monetary challenges. An emergency fund is designed to cover running prices within the occasion of a sales dip, consisting of in the course of a recession. This fund let you keep away from taking over debt or dipping into business property while cash flow is tight.

The perfect length of your emergency fund will vary relying on your industry, business size, and operational prices, however, an awesome rule of thumb is to have enough price range to cover three to six months of costs. Even in case your enterprise is going through monetary problems, putting apart a small percentage of profits in the direction of this fund will in the end offer the financial cushion you want while the going gets difficult.

Diversifying Revenue Streams to Reduce Risk

One of the high-quality approaches to constructing resilience against a recession is by means of diversifying your revenue streams. Businesses that depend on a single product, carrier, or customer base are more vulnerable at some point of economic downturns. By exploring new markets, products, or offerings, you can create extra resources of profits that could maintain your enterprise afloat if one move starts off evolving to sluggish.

For example, if your primary business relies on in-person events, consider pivoting to provide virtual offerings. If you provide physical products, you may discover virtual merchandise or subscription-based fashions to seize an exceptional target audience. The key to diversification is ensuring that every new move complements your existing offerings, as opposed to spreading your resources too thin.

Leveraging Professional Help for Financial Management

While many companies can also try and control their finances in residence, looking for external expertise may be pretty valuable. Working with an Outsourced Accounting Firm for Startups can help you streamline your financial processes, ensuring that your accounting and tax strategies are aligned with excellent practices.

Outsourcing to an expert corporation additionally permits you to be aware of developing your commercial enterprise, in preference to getting bogged down by way of bookkeeping or complex economic reporting. Accountants with experience in your industry can provide strategic insights and steering that can save your enterprise cash in the end, mainly while confronted with tough monetary situations.

Focusing on Debt Management and Credit Strategies

Debt can be a prime burden at some stage in a recession, and powerful debt control ought to be part of any recession-proof monetary plan. Prioritizing high-interest debts and negotiating higher terms with lenders can unfasten up cash that may be reinvested into the enterprise.

It’s also vital to maintain a terrific credit rating, with the intention to make it simpler to access financing within the future. Keeping your business’s debt load doable and paying off excessive-interest loans can improve your financial outlook, even in hard times.

Monitoring Key Financial Metrics

It’s not enough to create a financial plan and wish it works. Regularly monitoring key financial metrics, along with cash flow, profit margins, and expenses, is essential to stay on course. These metrics will come up with a clear picture of your enterprise’s monetary health and help you become aware of potential problems before they become essential issues.

With the proper gear and procedures in place, you may music those metrics in real-time and regulate your strategy therefore. The extra proactive you are in managing your price range, the higher organized you’ll be for any economic challenges that come your way.

Investing in Technology to Improve Financial Efficiency

In today’s international, leveraging era is one of the only ways to enhance monetary control and efficiency. Tools like accounting software programs can automate many manual responsibilities, which include invoicing, tracking expenses, and generating reviews. These gear no longer most effectively keep time but additionally lessen the chance of human mistakes, supporting you in maintaining correct monetary statistics.

Additionally, choosing Online Accounting Services can provide your enterprise with the power to manage price range remotely, ensuring you always have get entry to to updated information, irrespective of in which you are. With cloud-based total services, you could collaborate with economic experts in actual time, making it less complicated to alter your economic approach and reply to economic challenges as they arise.

Cultivating a Recession-Proof Mindset

Finally, building a recession-evidence financial plan isn’t pretty much numbers—it’s about mindset. Encourage your team to live focused, adaptable, and answer-oriented, even if confronted with limitations. Fostering a way of life of resilience inside your company can assist all of us work collectively to navigate tough times. Small wins and superb momentum will help hold morale high, even when outside conditions are less than perfect.

By embracing a recession-proof mindset, you can not best live on tough instances however additionally emerge from them more potent and more prepared for future increases.

Conclusion

Building a recession-proof monetary plan is crucial for businesses of all sizes. With the proper strategies in the vicinity—inclusive of diversifying sales streams, coping with debt, leveraging era, and searching for expert monetary steerage—you can assist your business to continue to be solid at some point of times of monetary uncertainty. By focusing on flexibility, resilience, and proactive economic control, you’ll be better geared up to address whatever challenges come your way.