Modern price charts can look chaotic to the untrained eye. Candles rise and fall, wicks appear and vanish, and indicators often contradict each other. Yet beneath this apparent randomness lies a structured logic driven by liquidity, order flow, and institutional intent. This is where ICT abbreviations and meanings become essential.

The ICT (Inner Circle Trader) methodology, introduced by Michael Huddleston, is not simply another trading system. It is a framework for understanding why price moves, not just when it moves.

Instead of relying on lagging indicators, ICT trading focuses on market structure, liquidity dynamics, and the behavior of large financial players such as banks, hedge funds, and market-making algorithms.

To navigate this framework effectively, traders must first learn its language. ICT uses a dense set of abbreviations and terms that act as shorthand for complex market behavior. Once understood, these trading terms transform charts into readable narratives of accumulation, manipulation, and expansion.

What the ICT Trading Model Attempts to Explain

At its core, ICT trading is built on one assumption: markets are engineered to seek liquidity. Price does not move randomly; it is delivered through algorithms designed to fill large institutional orders efficiently.

ICT analysis trains traders to:

- Recognize shifts in directional bias through structure changes;

- Locate areas where liquidity is concentrated;

- Identify institutional footprints left behind during large transactions;

- Time entries and exits with precision rather than prediction.

This approach requires abandoning the idea that indicators “cause” price to move. Instead, ICT traders study how price reacts around specific zones, time windows, and liquidity pools. The abbreviations used in ICT are simply compressed ways of describing these behaviors.

Core ICT Abbreviations Every Trader Encounters

Among the many ICT concepts, several abbreviations form the backbone of most models. Understanding these is not optional, it is foundational.

Fair Value Gap (FVG)

A Fair Value Gap (FVG) represents an inefficiency in price delivery. It typically forms when a strong displacement move leaves a gap between the first and third candles of a three-candle sequence.

This gap signals that the price moved too aggressively to allow balanced trading. Markets frequently revisit these zones to rebalance that imbalance. Within ICT logic, an FVG is not a support or resistance level; it is a magnet created by inefficient execution.

Traders monitor FVGs to anticipate retracements, refine entries, or identify logical take-profit areas when price revisits these inefficiencies.

Market Structure Shift (MSS)

A Market Structure Shift (MSS) marks a change in directional intent. It occurs when price violates a key swing high or low that previously defined the trend.

Unlike traditional trendlines, MSS focuses on internal structure. It suggests that Smart Money may be transitioning from buying to selling, or vice versa. This makes MSS one of the earliest signals that bias may be changing, often before retail traders recognize it.

Within ICT frameworks, MSS is frequently used to confirm potential reversals or the beginning of a new expansion phase.

Power of Three (PO3)

The Power of Three (PO3) explains how markets often unfold within a session or trading day. It divides price action into three phases:

- Accumulation: Price compresses within a range while liquidity builds;

- Manipulation: Price sweeps one side of the range to trigger stops;

- Distribution: Price expands aggressively in the intended direction.

PO3 teaches traders why false breakouts are common and why chasing price after manipulation often leads to losses. When aligned correctly, PO3 provides a timing framework that pairs structure with session-based behavior.

Order Block (OB)

An Order Block (OB) is a price zone where institutional buying or selling occurred before a significant move. These areas represent unfilled or partially filled large orders.

- Bullish Order Blocks often precede upward expansions

- Bearish Order Blocks typically appear before sharp declines

Price frequently returns to these zones for mitigation, allowing institutions to complete remaining orders. For ICT traders, OBs are not just zones to enter; they are clues revealing where Smart Money previously committed capital.

Optimal Trade Entry (OTE)

The Optimal Trade Entry (OTE) model blends Fibonacci retracement levels with ICT structure and liquidity concepts. Rather than using Fibonacci mechanically, OTE focuses on retracement zones, commonly between 61.8% and 79%, that align with institutional behavior.

An OTE setup is not valid on its own. It must align with bias, structure, and liquidity context. When it does, it allows traders to define risk tightly while targeting asymmetric reward potential.

Structural Terminology That Shapes ICT Analysis

Beyond the main abbreviations, ICT introduces several structure-related terms that explain how trends form, weaken, or reverse.

∙ Break of Structure (BOS): It occurs when the price breaks a previous high or low in the direction of the current trend. It signals continuation rather than reversal and confirms that the market is still delivering prices in the same direction;

∙ Break of Market Structure (BMS): It implies a deeper shift. Instead of a single swing break, it reflects a broader change in how the price is behaving. BMS often suggests a developing reversal rather than a simple continuation;

∙ Change of Character (CHoCH): It highlights a sudden alteration in price behavior. For example, a bullish market that begins forming lower highs may be showing early distribution. CHoCH often precedes MSS and serves as an early warning signal;

∙ Change in State of Delivery: It refers to adjustments in how price moves, such as shifts in volatility, range expansion, or reaction speed around liquidity zones. These changes often reflect algorithmic recalibration rather than news-driven volatility;

∙ Consequent Encroachment (CE): It is typically the midpoint of an imbalance, such as an FVG. Price revisiting this midpoint suggests rebalancing rather than continuation and can act as a reaction level during retracements.

Liquidity Abbreviations and Their Meanings in ICT

Liquidity is the fuel behind every institutional move. ICT analysis revolves around identifying where that fuel exists and how price is engineered to access it.

Key liquidity-related abbreviations include:

- BSL (Buy-Side Liquidity): Buy stops clustered above highs

- SSL (Sell-Side Liquidity): Sell stops resting below lows

- LP (Liquidity Pool): A concentration of pending orders

- LV (Liquidity Void): Areas of thin trading where price moves rapidly

- PD Array: A framework for identifying premium and discount zones

Institutions often drive prices toward these pools to trigger orders, creating the momentum required for large directional moves. Understanding liquidity shifts allows traders to anticipate stop runs rather than becoming victims of them.

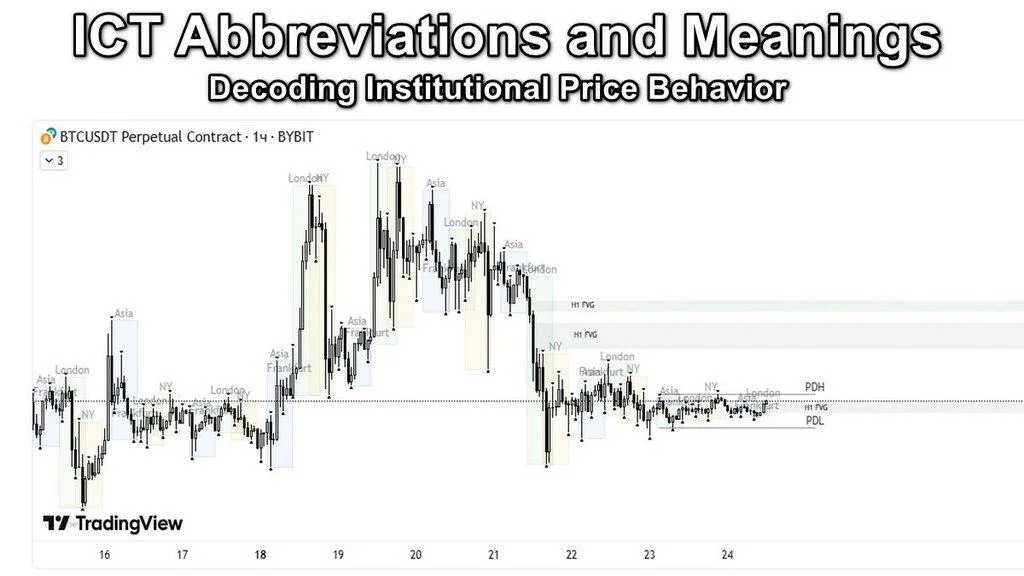

The Role of Time and Trading Sessions in ICT

Time is not neutral in ICT trading. Different sessions introduce different liquidity conditions.

- Asian Session: Often establishes the initial range;

- London Session: Frequently delivers manipulation or early expansion;

- New York Session: Commonly completes distribution.

ICT traders analyze session highs and lows to identify where liquidity rests and how price reacts when those levels are approached or violated. This time-based structure adds another layer to understanding ICT abbreviations and meanings in real market conditions.

Final Thoughts

Learning ICT abbreviations and meanings is not about memorization, it is about developing fluency in how markets actually operate. These terms describe structure, liquidity, and execution mechanics that remain invisible to indicator-based approaches.

When traders understand this vocabulary, charts stop feeling random. Price action becomes a sequence of cause and effect, driven by liquidity objectives and institutional order flow.

By mastering concepts such as FVG (Fair Value Gap), OB (Order Block), MSS (Market Structure Shift), and PO3 (Power of Three), traders open a window into the institutional logic that governs market dynamics.

Mastery of ICT terminology does not guarantee success, but it equips traders with a framework grounded in logic rather than guesswork. Over time, this shift in perspective can transform trading from reactive speculation into structured market interpretation built around Smart Money principles.

Frequently Asked Questions

What are ICT abbreviations and why are they important?

ICT abbreviations are short terms that describe market structure, liquidity, and institutional behavior. They help traders read price action logically instead of relying on lagging indicators.

Is ICT trading suitable for beginners?

Yes, but it requires study and patience. Beginners must first learn ICT abbreviations and meanings to understand how price reacts around liquidity and structure.

How is an ICT Fair Value Gap (FVG) different from support and resistance?

An FVG is an imbalance caused by inefficient price delivery, not a historical reaction level. Price often returns to it to rebalance institutional execution.

Can ICT concepts be used on any market or timeframe?

Yes, ICT principles apply to forex, indices, crypto, and commodities across all timeframes, as they are based on liquidity and order flow mechanics.