Eicher Motors is a leading name in the Indian automotive industry, known for its strong presence in both commercial and two-wheeler segments.

With its iconic brand, Royal Enfield, and the growth of its commercial vehicle division, Eicher is making significant strides. As the company faces competition and market challenges, many wonder about its future.

In this article, we will explore Eicher Motors’ growth prospects, current strategies, and what lies ahead for the company in the rapidly evolving Indian automotive market. So, let’s first discuss the dominance of Royal Enfield in the two-wheeler market.

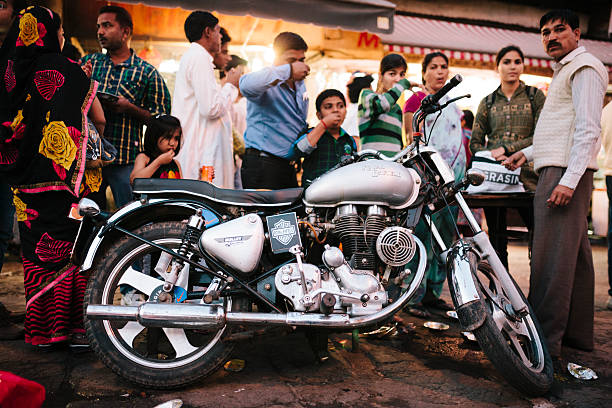

Performance of Royal Enfield

In the 2024-2025 fiscal year, Royal Enfield achieved a historic milestone by surpassing 1 million motorcycle sales, marking the highest annual sales in the company’s history.

The total sales reached 10,09,900 units, an 11% increase from the previous fiscal year’s 9,12,732 units. Domestic sales contributed 9,02,757 units, reflecting an 8% year-on-year growth, while exports saw a 37% rise, totaling 1,07,143 units.

This growth is attributed to new product launches and enhanced marketing efforts. However, this focus on volume has led to higher marketing expenditures and a shift towards lower-margin models, resulting in a six-quarter low in gross profit per vehicle.

While this growth-over-profit strategy has expanded Eicher Motors’ market share, it poses challenges for long-term profitability.

Developments in the Commercial Vehicle Segment

VE Commercial Vehicles (VECV), a joint venture between Eicher Motors and the Volvo Group, has significantly advanced its commercial vehicle segment through strategic innovations.

In February 2025, VECV introduced the Eicher Pro X series, marking its entry into the small commercial vehicle (SCV) market. This electric-first range, unveiled at the Bharat Mobility Global Expo 2025, is tailored for urban and near-city logistics, featuring best-in-class energy efficiency and a spacious cargo area.

Developed with insights from over 1,000 customers, the Pro X series emphasizes driver comfort and safety, incorporating advanced features like air-conditioned cabins and driver state monitoring systems.

At VECV’s Bhopal plant, which operates under Industry 4.0 standards, the Pro X series stands as a testament to the company’s commitment to commercial vehicle sustainability and innovation.” This has impacted Eicher Motors share price, which is at present Rs. 5570+.

Challenges and Opportunities Ahead

Eicher Motors faces challenges such as supply chain disruptions, notably semiconductor shortages affecting production timelines and costs.

On top of that, the growing shift towards electric vehicles necessitates significant investments in EV technology to maintain competitiveness.

However, opportunities lie in expanding the premium motorcycle segment, where models over 350cc saw a 44% year-on-year growth in January 2025.

The commercial vehicle sector also presents growth potential, with VECV achieving a 20.1% annual sales increase to 8,489 units in January 2025.

However, being an automobile manufacturer, Eicher Motors is prone to certain limitations like changes in technology and consumer preferences, competitive pricing, and market fluctuation. Thus, as an investor, you should understand your risk tolerance level and goals to make an informed decision and focus on diversification. Always conduct your research before investing and keep a long term focus.

Conclusion

Eicher Motors, which is a part of Nifty Auto, is strategically focusing on increasing sales volume, particularly through its Royal Enfield brand, which has seen significant growth. Developments in its commercial vehicle segment, such as the Medium Duty Engine Project, are expected to enhance market presence. However, challenges like market competition and margin pressures persist. Overall, Eicher Motors is well-positioned for growth in the Indian automotive sector.