Ready to take your business to the next level?

Emerging markets offer huge growth opportunities and equipment financing can open many doors in high-growth developing economies. The thing is…

Few companies succeed because they don’t realize just how different these markets are for financing equipment.

The bottom line is:

Emerging markets can be super risky if you’re not prepared and a bad financing deal can sink your investment. But with smart business finance solutions, the right knowledge and planning you can avoid the pitfalls and find success.

In this guide, you’ll learn the most important things you need to consider before financing equipment in developing economies.

Let’s get into it!

What you’ll discover:

- Emerging Market Characteristics

- The Biggest Financing Challenges

- Risk Mitigation Strategies

- Choosing the Right Financing Partner

- Local Market Regulations

Emerging Market Characteristics

Did you know this?

Emerging markets are experiencing faster economic growth than developed countries. For example, Asia Pacific alone holds 40.2% of the construction equipment finance market globally, making it one of the biggest markets for this type of equipment.

But this doesn’t mean that emerging markets are straightforward.

Financing equipment there is very different to developed countries. It requires a distinct approach from some of the more traditional large capital equipment financing options we see in the developed world.

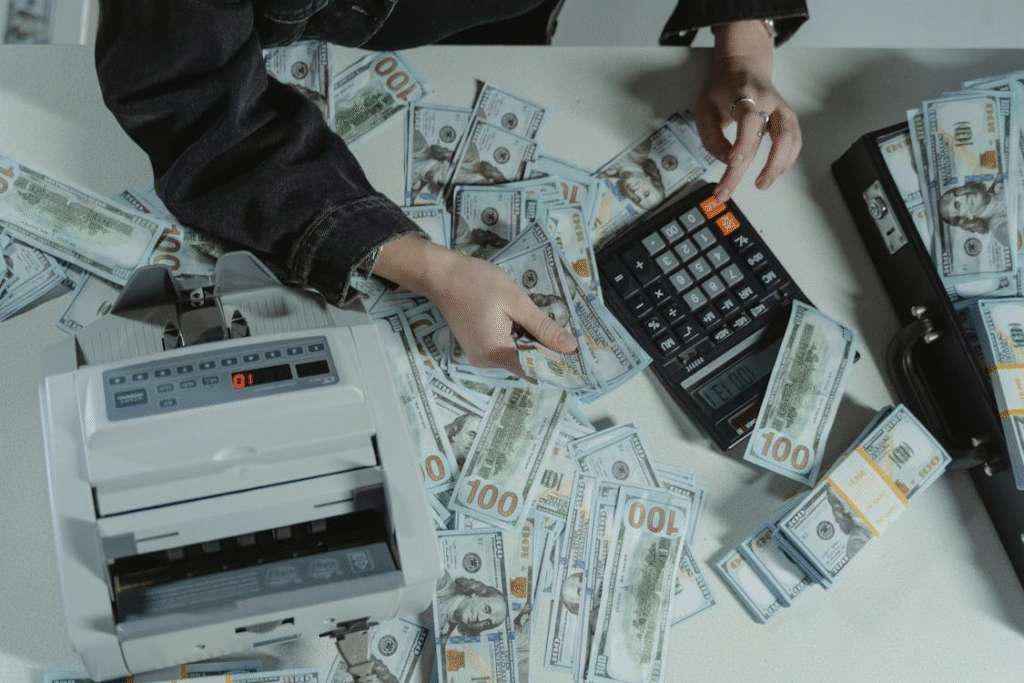

Getting the equipment you need might be the easy part. Securing business finance solutions to buy it is a whole different challenge.

The Biggest Financing Challenges

Ok, let’s talk real talk…

Financing equipment in developing countries and economies is a serious undertaking. Without doing your homework, your financing experience can become a financial nightmare.

Credit History and Documentation

Let me be blunt with you:

A lot of businesses in emerging markets don’t have documented financial histories. This makes it hard for traditional banks to offer them financing.

Application processes can be very complex. Borrowers may not be familiar with required documentation. The need for collateral is also often very high.

Currency and Exchange Rate Risk

Here’s something to consider:

If your equipment is priced in dollars but your business revenue is in local currency, exchange rate volatility can significantly affect your equipment’s actual cost.

Currency fluctuations can make or break your investment. You have to account for this risk when doing the numbers on your financing deal.

High Interest Rates

Did you know this?

Interest rates on loans and financing in emerging markets are often higher than in developed countries. Lenders price in the higher risk of doing business in these regions.

Higher interest rates mean that the cost of financing equipment eats into your profit margins.

Risk Mitigation Strategies

Emerging markets can be risky, there’s no getting around it.

The secret is to understand the risks and put strategies in place to mitigate them. By planning for and avoiding risk, you can secure smart equipment financing.

Political and Economic Stability

One of the biggest risks is political instability.

Changes in government or political unrest can lead to policy shifts or economic instability. This can impact the terms of your financing agreement.

Look at the political history of the country. Has there been consistent leadership or frequent changes? Is there a risk of government expropriating assets? These factors can affect your financing terms and investment returns.

Infrastructure and Operational Risks

Infrastructure quality can also pose a risk.

Inadequate roads, ports, or energy supply can lead to operational inefficiencies and increased maintenance costs.

Look at the state of the infrastructure where you plan to operate. Are the roads in good condition? Is there a stable power supply? Evaluate these operational risks as they can directly impact your equipment’s performance and cost.

Legal and Regulatory Risks

One more thing to watch out for is legal and regulatory risks.

Laws and regulations regarding equipment financing can be inconsistent or underdeveloped in emerging markets. Understanding local legal protections is important before signing any financing agreement.

Research the local legal framework. Are contracts enforceable through the local judicial system? What is the process for recovering funds or equipment in case of default?

Choosing the Right Financing Partner

Let’s face it…

Not all financing partners are created equal. When it comes to emerging markets, you want a partner who is familiar with the local conditions and has experience navigating them.

You need a financing partner who has boots on the ground. You need someone who understands local business culture, regulatory requirements, and has established relationships in the market.

Local Market Expertise

Look for a partner with strong local knowledge and connections.

A partner with an in-country presence is invaluable. They can provide insights into local business practices and cultural nuances that can make or break a deal.

They can help you structure your financing agreement to work with local conditions.

Flexible Financing Solutions

One-size-fits-all financing solutions often fall short in emerging markets.

Look for a partner that offers flexible terms and can adapt their products to your needs. This might include longer repayment periods or non-traditional collateral requirements.

Flexibility is key in markets where economic conditions can change rapidly.

Local Market Regulations

Compliance with local laws and regulations is not optional.

Emerging markets have their own sets of rules around equipment financing. These laws can have a big impact on your financing arrangements.

Import/Export Rules

Equipment often needs to cross international borders, which involves dealing with import/export regulations and customs duties. These costs and delays should be built into the financing arrangements.

Some countries have incentive programs for importing certain types of equipment. Research these opportunities before finalizing a financing deal.

Tax Considerations

Tax treatment of equipment financing can vary greatly from one market to the next.

In some places, lease payments are fully tax deductible. In others, the tax rules may favor outright purchases.

Work with local tax experts who understand the letter and the reality of the law.

Environmental/Safety Standards

Compliance with local environmental and safety standards for the equipment itself is also important. Some emerging markets are enforcing these standards more strictly.

This is a particular concern with heavy machinery, manufacturing equipment, and anything with potential environmental impacts.

Next Steps

Equipment financing in emerging markets can be a challenge, but the payoff can be worth it.

Businesses willing to do the research and plan their approach carefully can tap into some of the world’s fastest-growing economies.

Start by researching the market you’re interested in. Political stability, economic outlook, legal protections, regulatory environment.

Then find a financing partner with local experience and flexibility.

Remember:

- Credit history requirements make traditional financing hard in many emerging markets

- Currency and interest rate risks can seriously affect your equipment’s real cost

- Local experience is invaluable for equipment financing in developing countries and economies

- Compliance with local laws and regulations is a must

- Flexible financing terms are the ones that will actually work

Equipment financing in emerging markets isn’t easy, but it’s also not something to be avoided.

There are risks, but by planning for them you can sidestep many of the biggest problems. Local expertise and smart business planning can pay off handsomely when you find a financing partner with the experience to execute.

The emerging markets are one of the world’s largest and fastest-growing economies. By getting equipment financing right, your business can tap into this growth and establish a foothold in high-growth developing economies.